Greater Victoria’s real estate market ended 2022 with sales down almost a third from the year prior, as rising inflation eroded buying power.

A total of 6,804 properties changed hands last year, down from 10,052 in 2021.

Last year’s overall sales were closest to 2014’s number of 6,698.

Karen Dinnie-Smyth, president of the Victoria Real Estate Board, said the year began with record-low inventory and higher-than-average sales, but then “changed on a dime.”

Interest-rate increases through the rest of the year signalled the end of low-cost borrowing, she said, adding every time rates went up, the market slowed.

Dinnie-Smyth said she expects the cost of moving and borrowing money to continue to undermine demand into 2023.

On the plus side, slower sales activity has led to inventory levels rebounding from historic lows, meaning there are more properties for sale, she said.

Dinnie-Smyth called a new federal ban on foreign buyers a disappointing politically motivated attempt to slow demand, rather than addressing the “more lengthy and less politically popular process” of building more housing supply.

The ban is unlikely to reduce housing costs because there are so few foreign buyers in the market, she said.

At the same time, a new cooling-off period for buyers is already out of date because the market has slowed, she added.

Supply shortfalls will continue, pushing up prices, if governments fail to encourage new development, Dinnie-Smyth said.

Tammi Dimock, a real estate agent with Royal LePage who has specialized in Sooke for 32 years, expects the market to remain slow while interest rates continue to climb.

The Sooke area has more affordable homes, but rising interest rates are taking a toll, she said.

One couple she worked with purchased a house but did not lock in their mortgage rate. When they bought, the rates were lower. But now it’s time to refinance, they don’t qualify for a mortgage any more, and have been forced to list their home for sale, Dimock said.

“They are being pushed out of the market based on today’s interest rates,” she said. “It is a tough time for a lot of people right now.”

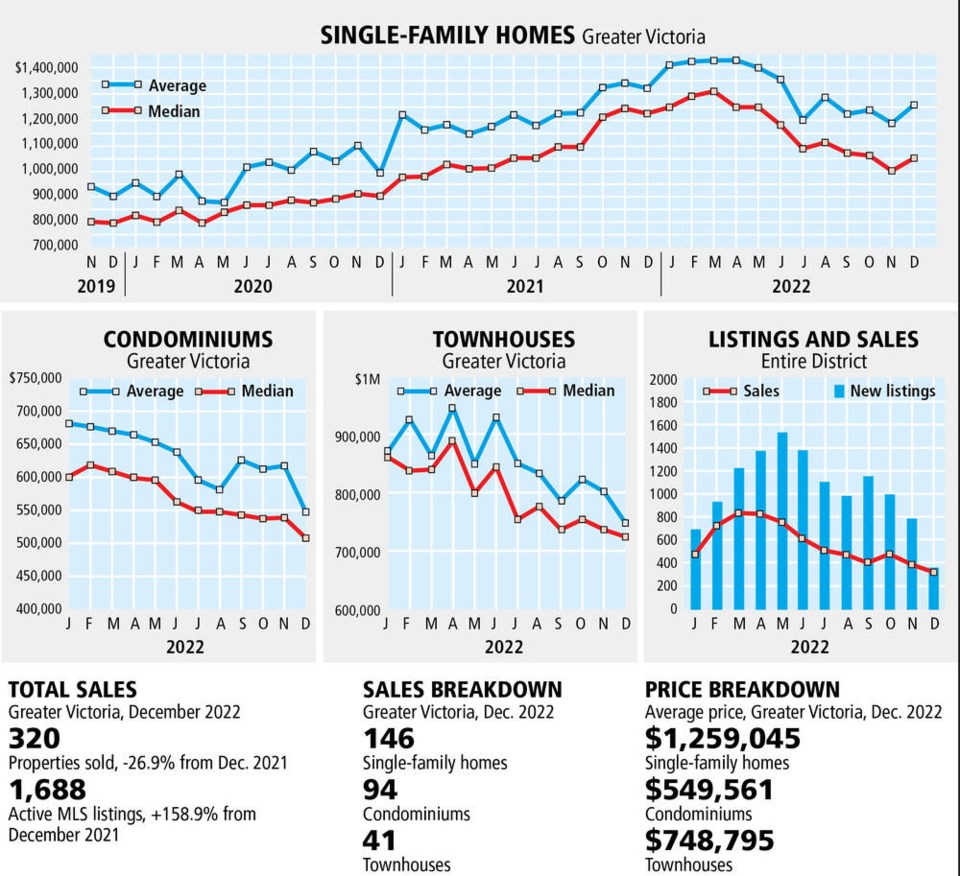

A total of 320 properties in the capital region changed hands through the real estate board last month, down 26.9 per cent from December 2021, when 438 properties sold.

December sales were also down 16.7 per cent from November.

Sales of both condominiums and single-family homes slumped.

A total of 94 condominiums sold in December, down from 152 in the same month last year.

Last month saw 156 single-family homes sold, a drop from 207 in December 2021.

Year-over-year prices show a modest increase for December. The benchmark value of a single-family home in the core area of Victoria was $1,283,600 last month, up slightly from $1,262,600 the same month in 2021.

The benchmark for a condo in the Victoria core was $574,300 last month, up from $544,100 in December 2021.

cjwilson@timescolonist.com